In the drop down menu, scroll all the way down and select 'Support + Resistance Lines'. Then click 'Select Overlay To Add' in the lower ticker field.

#RISING WEDGE TRADING PLUS#

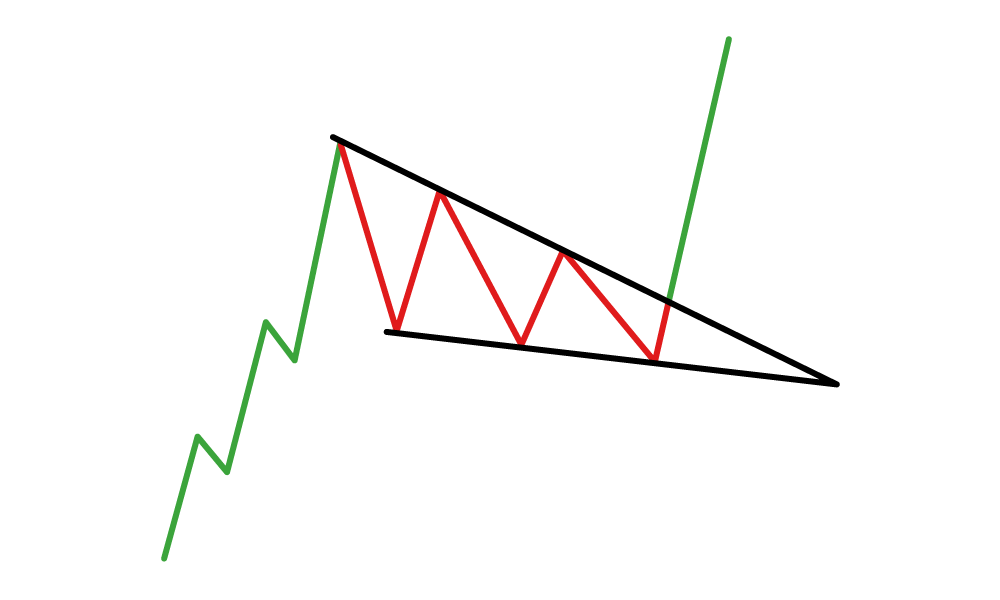

Choose the 'Main Chart' tab and click on the plus sign (blue button). If the wedge formations are not visible on the chart, it means that the chart settings still need to be adjusted. In this case, ChartMill will search for wedges within a time frame of up to 60 periods. Then open the drop down menu under 'Chart Patterns'. To configure the filters, go to the Stock Screener page and select the 'Indicators' tab. Below a few recent results of the filter 'Rising Wedge - ST'. The filter can perfectly serve as a basis for a first selection which can then be further fine-tuned manually. Wedge Screenfilters in ChartMillĬhartMill offers the possibility to screen for Rising Wedges. Price target was achieved on date of May 10, 2021Ī 3R gain was even achieved on date of June 18, 2021. As a reminder, in a rising wedge, it is the lower trend line of the pattern that rises faster than the upper one. What is really important is that the two lines of the pattern strongly converge to each other and that one of the two lines has a clearly stronger degree of rising or falling than the other line. Good rising wedge setups don't happen that often. The subsequent price target is the low of the pattern itself (B) Trading example for the Rising Wedge chart pattern The first price target (D) in a downward breakout is generally taken to be the distance equal to the largest possible difference between the upper and lower trend line within the pattern itself (A > B). Going long based on this upward price breakout is highly speculative because the probability of an at least equally sharp decline is quite significant. When they do occur, these are usually extended moves with high momentum which usually occur at the end of a (strongly) rising trend (recognizable by the sudden considerable distance from, for example, the SMA20). The disadvantage versus the classic breakout is that if the initial move is strong and continues immediately you will be too late to jump on board Rising Wedge Breakout above the upper trendlineīreakouts above the upper trendline are not very common but they do exist. The advantage of this way is that from a risk/reward standpoint it usually yields the best setups. Retest of the initial breakout levelĪs with many other patterns, you can opt not to trade the initial breakout and wait for the price to retest the breakout level.

If that happens, further downward movement is expected. Rising Wedge Breakout below the lower trendlineĭespite the fact that the pattern itself is created by a succession of increasingly higher bottoms and tops, this is a typical bearish reversal pattern and not a continuation pattern as is the case with the triangle formations, for example.Ī rising wedge assumes a breakout below the lower rising trend line (the trendline with the sharpest slope). To increase the reliability of the pattern, there must be at least 5 reversal points within the pattern, ignoring the exact starting point on the lower and upper trendlines. a lower rising trend line with a sharper slope than the upper one, representing the intermediate bottoms.an upper uptrend line representing the tops.The difference in slope between the lower and upper rising trend line creates the typical wedge pattern

The lower trend line is steeper than the upper trend line which in itself is a sign that buyers are moving increasingly faster into the market during intermediate price dips. A rising wedge is a chart pattern characterized by two rising trend lines running in the same direction but with different slopes.

0 kommentar(er)

0 kommentar(er)